Many people try to make a budget, but most budgets fail within a few weeks. The reason is simple. Most budgets are too strict, too confusing, or unrealistic. A budget should not make you feel stressed or guilty. A good budget should give you control, clarity, and confidence about your money.

Creating a monthly budget that actually works is not about cutting all fun from your life. It is about understanding your money, making smart choices, and planning in a way you can follow every month. This guide explains how to create a realistic monthly budget step by step, even if you are a beginner.

What Is a Monthly Budget?

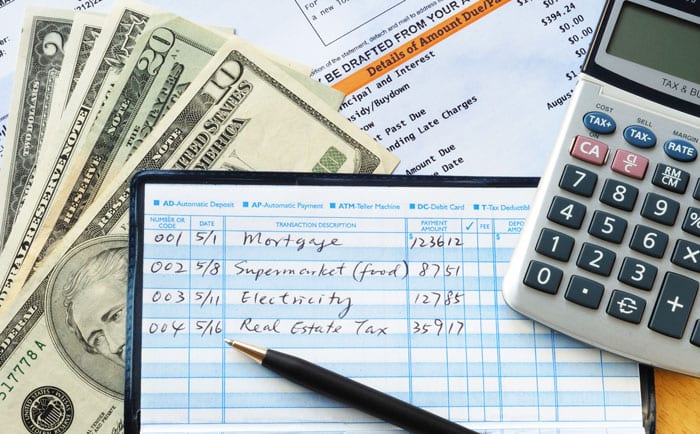

A monthly budget is a simple plan that shows how much money you earn and how you will spend, save, and manage it during the month. It helps you decide in advance where your money should go.

Without a budget, money disappears quickly. With a budget, you know exactly what you can spend and what you need to save. A budget gives direction to your money instead of letting it control you.

Why Most Budgets Fail

Many people fail at budgeting not because they are bad with money, but because the budget is poorly designed.

Some budgets fail because they are too strict. When there is no room for enjoyment, people stop following the budget.

Other budgets fail because people guess their expenses instead of tracking real spending. Some fail because savings are treated as optional instead of important.

A budget works only when it matches your real life, not an ideal version of it.

Step 1: Know Your Real Monthly Income

The first step in creating a working budget is knowing how much money you actually earn.

Always calculate your take-home income, not your gross salary. Take-home income is the money you receive after tax and deductions.

If your income is fixed, this step is easy. If your income changes every month, calculate an average based on the last six months. This gives you a realistic number to work with.

Never budget money you have not earned yet. This is a common mistake that leads to overspending.

Step 2: Track Your Expenses Honestly

You cannot create a budget without knowing where your money goes. Tracking expenses is one of the most powerful money habits.

Track every expense for at least one full month. Include rent, groceries, transport, bills, online subscriptions, shopping, eating out, and small daily purchases.

Many people are surprised to see how much money goes to small expenses. These small amounts often destroy budgets quietly.

Tracking expenses shows you the truth about your spending. Only when you know the truth can you improve it.

Step 3: Separate Needs and Wants

Once you know your expenses, divide them into two groups.

Needs are expenses you must pay to live. These include rent, basic food, electricity, water, transport, insurance, and minimum loan payments.

Wants are lifestyle expenses. These include eating out, shopping, entertainment, travel, and subscriptions.

This step is important because it helps you decide where you can cut back if needed, without hurting your basic lifestyle.

Step 4: Set Clear Financial Goals

A budget without goals feels pointless. Goals give your budget meaning.

Set short-term and long-term goals. Short-term goals may include saving for emergencies, travel, or a purchase. Long-term goals may include buying a home, education, or retirement.

When you know what you are saving for, it becomes easier to control spending. Goals turn budgeting from restriction into motivation.

Step 5: Choose a Simple Budgeting Method

A budget works best when it is simple. Complex systems often fail.

One popular method is the 50-30-20 rule. In this method, 50 percent of income goes to needs, 30 percent to wants, and 20 percent to savings.

This rule is flexible. If your income is low, needs may take more than 50 percent. If you want to save more, you can reduce wants.

The key is not the exact percentage. The key is balance and consistency.

Step 6: Pay Yourself First

One of the biggest budgeting mistakes is saving whatever is left at the end of the month. Usually, nothing is left.

A working budget treats savings like a fixed expense. This is called paying yourself first.

Decide how much you want to save and move that money as soon as you receive your income. When savings happen first, spending automatically adjusts.

Even small regular savings are powerful when done consistently.

Step 7: Create Realistic Spending Limits

Your budget should match your real habits. If you usually spend on eating out or shopping, your budget must allow some money for it.

Cutting expenses is important, but cutting everything at once does not work. Reduce slowly and realistically.

A budget that allows small enjoyment is more likely to succeed than a strict budget that feels like punishment.

Step 8: Prepare for Irregular Expenses

Many budgets fail because of unexpected expenses that are actually predictable.

Expenses like annual insurance, festivals, gifts, repairs, or medical costs should be planned in advance.

Set aside a small amount every month for irregular expenses. This prevents sudden stress and budget failure.

Planning ahead is what separates a working budget from a broken one.

Step 9: Build an Emergency Fund

An emergency fund is essential for a stable budget. Without it, one emergency can destroy months of planning.

Aim to save at least three to six months of basic living expenses. If that feels difficult, start small.

Keep emergency savings separate from your regular spending account. This protects the money from being used unnecessarily.

A strong emergency fund makes budgeting easier and less stressful.

Step 10: Review and Adjust Every Month

A budget is not a one-time task. It is a monthly process.

At the end of each month, review your budget. Check where you stayed on track and where you struggled.

Life changes, and your budget should change with it. Adjust categories as needed instead of giving up.

A budget that improves over time always works better than a perfect budget that is never followed.

Common Budgeting Mistakes to Avoid

Many people repeat the same budgeting mistakes.

They forget to track spending.

They make budgets that are too strict.

They ignore savings.

They stop budgeting after one bad month.

Budgeting is a skill. Mistakes are part of learning. Do not quit because of one failure.

How a Budget Changes Your Life

A budget does more than manage money. It reduces stress, improves confidence, and helps you plan your future.

With a working budget, you stop worrying about money all the time. You know what you can spend and what you need to save.

Budgeting gives you freedom, not restriction.

Final Thoughts

Creating a monthly budget that actually works is about honesty, simplicity, and consistency. It is not about being perfect.

Know your income. Track expenses. Set goals. Save first. Spend mindfully. Review regularly.

When your budget matches your real life, you will finally stick to it. And when you stick to your budget, your money starts working for you instead of against you.